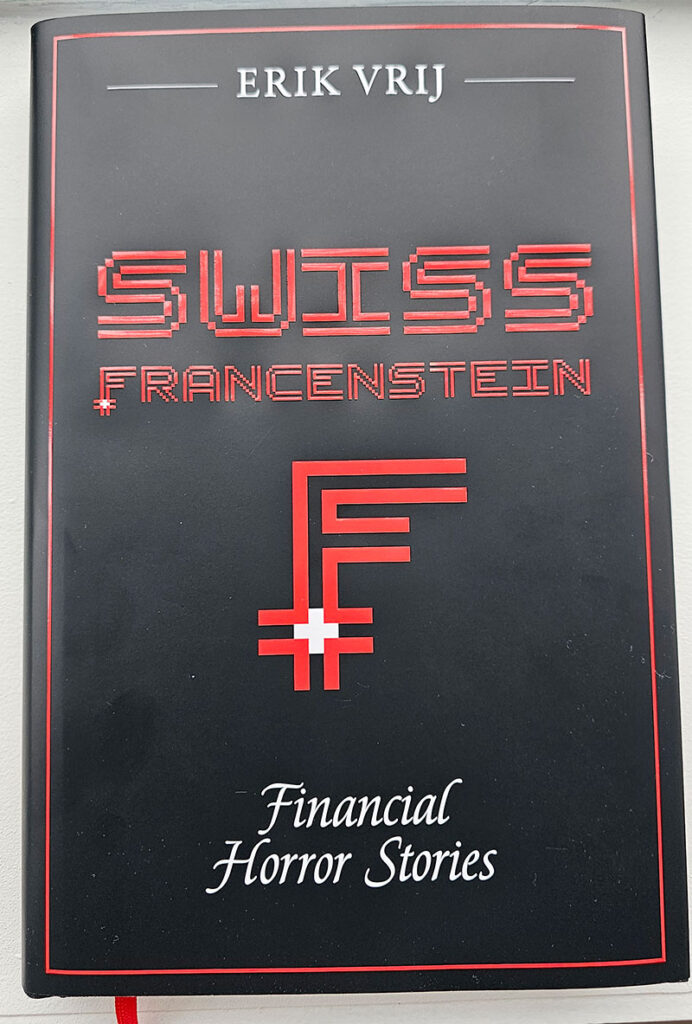

SWISS FRANCENSTEIN – FINANCIAL HORROR STORIES

A great read and gift for anyone in finance.

Swiss Francenstein – Financial Horror Stories is a the third book of a trilogy of books self-published by Erik Vrij, a banking and investment lawyer with over 27 years of experience with global banks.

The book includes 22 short financial horror stories. Most stories are loosely based on the title and narrative of the famous horror stories, movies and events i.e. Frankenstein, Dracula, Nightmare on Elm Street, Ghostbusters, An American Werewolf in London, The Strange Case of Dr. Jekyll and Mr Hyde, The Exorcist, Jack the Ripper, Silence of the Lambs, Poltergeist and more.

Other stories have been inspired by other titles and stories i.e. The Boys from Brazil, Death on the Nile, The Curse of the Pharaohs, Tinker Tailor Soldier Spy and American Kingpin.

The remaining stories are not based on any existing book or horror story,

As the below summaries of the stories show, all stories merge either actual horrific events that have occurred in the world of finance, events that could occur, are expected to occur or purely fictional financial events.

LOOK INSIDE AND READ A FEW STORIES HERE

HORROR STORIES INCLUDED

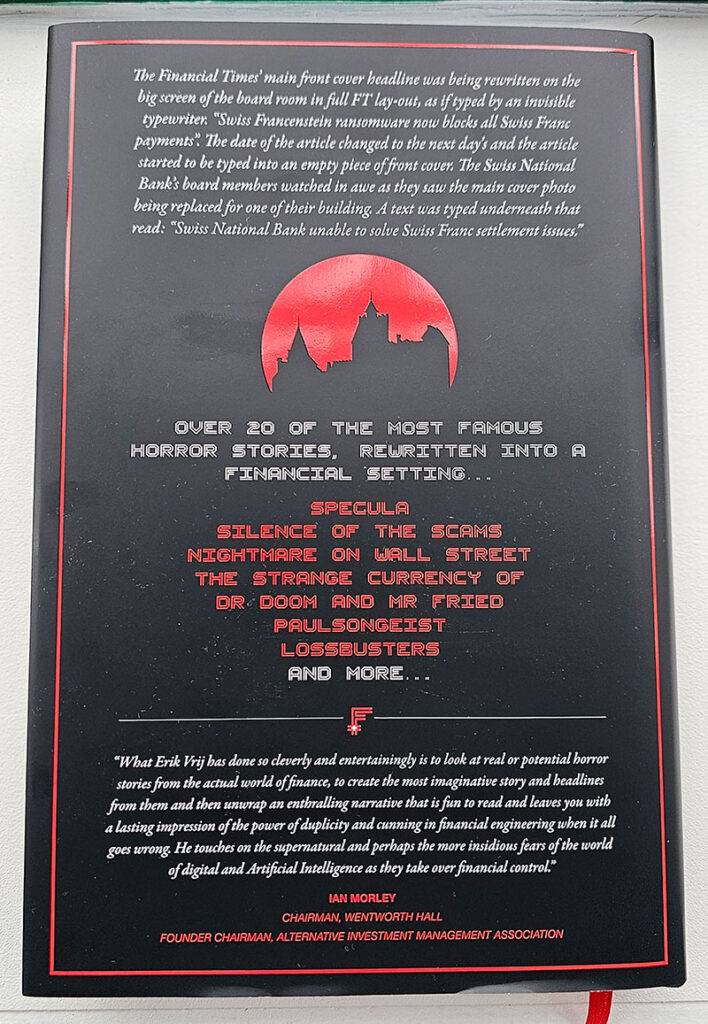

SWISS FRANCENSTEIN

The Swiss Franc is turned into a zombie currency by supernatural ransomware. The Swiss Central Bank stands powerless as it watches its settlements systems being taken over, preventing currency conversion and domestic settlement.

SPECULA

An investigative journalist is looking into Specula SRL, the mysterious investor behind a major blood transfusion company with unlikely growth and also behind an unprecedented pension loss. He discovers an investment company located in the Transylvanian Bran Castle (the alleged Dracula castle), aiming its investments to maximise “Misery under Management.”

LUCIFER’S LIGHTS

Spooky red coloured Northern Lights lookalike light dancing across the skies over global financial centres – soon named after the devil due to their effect – are disrupting financial transactions and misdirect payments to terrorists by sending ‘Unidentified Financing Objectives’. The world must adjust to the new reality.

AN AMERICAN BEARWOLF OFF WALL STREET

A Wolf of Wall Street like penny stock investor with offices in an unfashionable suburban New York location turns into a werewolf upon markets becoming bearish, eating associates.

LOSSBUSTERS

The shortest horror story of just one page, introduced Nobel Peace Prize Winner Ahmed as part of the Speed Meet & Greet TV show. Ahmed’s ‘Lossbusters’ vans have succeeded to prevent and reduce the hidden horrors of financial illiteracy, bad investments and poor financial decisions among the world’s poor.

THE STRANGE CURRENCY OF DR DOOM AND MR FRIED

Tense dialogue between Dr Doom (realistic on risk) and his alter ego Mr Fried (reckless profit drive) on horrific events unfolding after the launch of their ‘A-Live Coin’. It is a jointly created artificially intelligent and sentient cryptocurrency that has legal personality as well. It starts living its own horrific life with its pro-created subsidiary coins, facilitating money laundering, criminal dealings, and investment losses, but also massive profits for some.

NIGHTMARE ON WALL STREET

An actual nightmare of the CEO of a major global custodian of securities on Wall Street comes true. The bank becomes subject of a hack that blocks securities trading and triggers a global financial crisis.

THE EXTORTIONIST

A Private Equity firm’s managing partner employs horrific extortion methods to make portfolio company directors maximise profit.

THE ALGORITHM

Good looking charismatic and well-connected MIT graduate Alia – nicknamed ‘Algoria’ – unleashes a monstrous ‘Greedy Algorithm’ nicknamed ‘Aliagorithm’ on target SME customers of a start-up bank to reach the goal for the next venture capital funding round.

THE DARK POOL SYNDICATE

An upcoming terrorist organisation is ‘flash-financed’ by effectively a syndicate of anonymous investors through an Asian ‘dark pool’, a private securities exchange on which investments and investors are undisclosed. ‘Deep dives’ by authorities into the dark pool prove deadly.

THE BROKERS FROM BUCONERO

The world’s largest insurance company – BIG – funds its expected climate change triggered insurance claims through ESG funds with unorthodox investor solicitation: an army of ‘clonesultants’, cloned human beings that are programmed a biotech company to replicate the fundraising talent of the most notorious Ponzi-scheme operator, siphoning off part of the investments into the ‘Buconero’ (black hole) account.

JACK THE FLIPPER

A playboy real estate investor named Jack buys up mortgage loans sold off during an era of mass migration triggered by floodings and hurricanes, to invisibly on sell them to ruthless vulture funds doing anything to get full repayment from the home owners.

SILENCE OF THE SCAMS

A nerdy billionaire philanthropist’s ‘Better Planet Pledge’ foundation attracts many other billionaires to donate most of their wealth in its ESG funds. The foundation turns out to have a different notion of ESG: Elimination, Slavery and Geo-Politics.

HEDGECRAFT

A boutique Mayfair (London) law firm has a highly profitable Hedge Fund advisory practise based on ‘Midas Touch’ Managing Partner James ‘JJ’ John. Its clients have never made a loss. His voodoo methods ensure that counterparties of its clients will always be at the losing end of a deal.

THE CURSE OF THE ‘FUND PHARAOH’

An Egyptian hedge fund tycoon nicknamed the ‘Fund Pharaoh’ celebrates the 10th anniversary of his flagship ‘Pharaoh Fund’ with the key investors in his Pyramid Partners hedge fund. During the celebrations on his superyacht replica of Pharaoh Khufu’s famous solar ship, he reminds his investors that no investor has ever left Pyramid Partners and those leaving may be cursed. Some of them will find out.

THE BLACK SWAN FEEDER

The new Chief Investment Officer of a global fund manager – Brenda ‘Ballistic Brenda’ Black – decides to increase return on pension investments of its retiree investors, by investing indirectly into ‘Black Swan Bonds’, a new kind of catastrophe bonds issued by insurance companies that do not repay if a defined ‘Catastrophe Event’ occurs.

The retirees find out that their pensions heavily depend on catastrophes that are defined more like common accidents in the terms and conditions of the bonds, leaving them begging on the streets and living in tents. Brenda’s nickname soon changes to Brenda Black Monday

THE DARK WEB SPIDER

A successful adult entertainment entrepreneur expands her data driven business onto the dark web to become the leading financier on the Dark Web.

BENCHMARKED. BEWITCHED. BETRAYED.

The World Interbank Offered Rate (WIBOR) that determines the price of credit worth trillions, starts living its own life, being different on different screens, fluctuating randomly despite contractual arrangements and causing a trail of bankruptcies.

PAULSONGEIST

Legendary and ruthless hedge fund manager Paul Paulson dies in a legendary way: in his office upon unexpected news of his favourite stock. As his hedge fund fills the leadership gap with a wannabee, strange things start happening in the offices. Paul Paulson’s spirit is ever present.

USD-DAY

The day and period following the US Treasury’s default on payment of its gigantic sovereign debt, and the unsuccessful ‘Operation Overdue’ – based on D-Day’s ‘Operation Overlord’ – to prevent this from happening.

THE ACCOUNT OF BANCA MONTE-CRISTO

The new CEO of the oldest religion financing private bank – Banca Monte-Cristo – tries to head off its decline by big scale structured derivatives investments. Devilish mounting losses through double or quits investments are booked in account 666 under the radar of internal controls and accountants, trigger the biggest downfall and foreclosure of religious assets ever.

THE BAD-DAMNS FAMILY OFFICE

The members of the Bad-Damns Family come together at Bran Castle for their annual meeting to report on their Misery under Management. Many of the Characters of this book and of the previous book turn out to be members of the Bad-Damns Family, with an interest to create as much Misery under Management as possible. This chapter merges the previous trilogy book stories of fairy tales and poetry with horror.